Harvard, MA Rental Loans

Rental loans have transformed property investing throughout Harvard, giving strategic real estate entrepreneurs access to specialized financing based on rental income potential rather than personal financial statements. Watermen Capital, as premier rental property lenders serving Harvard investors, offers customized rental financing programs for both residential income properties (1 to 4 units) and small multifamily buildings (5 to 8 units) across all Harvard neighborhoods. Our rental loans evaluate each property based on its income generating capability, analyzing whether rental revenue sufficiently covers mortgage payments and operating costs. This investment centered approach enables Harvard property owners to build substantial portfolios more strategically than possible with conventional loans that prioritize borrower income verification over property performance metrics.

Watermen Capital's rental loans feature streamlined qualification processes designed specifically for Harvard property investors purchasing single family rentals, duplexes, triplexes, fourplexes, and multifamily buildings up to eight units. Our rental financing programs include attractive rates, adjustable terms, and loan structures optimized for income property economics. As dedicated rental property lenders with extensive experience in Harvard's diverse rental markets, we understand neighborhood dynamics, income potentials, and the operational expenses that impact investment returns. Whether acquiring your first income property or expanding an established rental portfolio, our rental loans provide the dependable financing foundation necessary for creating lasting wealth through Harvard real estate investments.

Home Value Trend for Harvard

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $994,019 | $1,141,058 | $1,200,768 | $1,274,164 | $1,283,633 |

Get a No-Obligation Rental Loans Quote

Other Loan Services for Harvard

Where We Lend

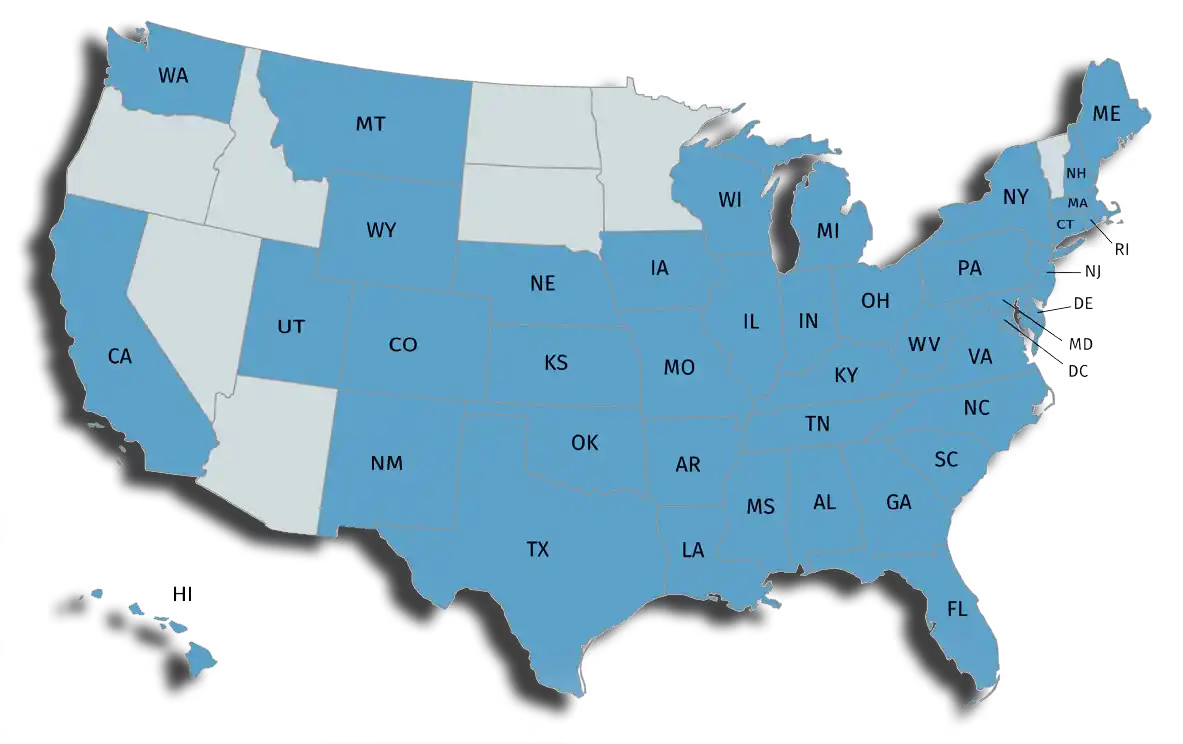

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.