Terrell County DSCR Loan

DSCR loans from Watermen Capital transform how Terrell County investors approach rental property financing by emphasizing asset performance over borrower income documentation. Our specialized DSCR lending services support acquisition and refinancing of income producing properties from single family homes through eightplexes across Terrell County's diverse municipalities. These DSCR financing solutions evaluate rental income potential against debt service requirements, creating qualification pathways that align with actual property performance rather than personal earnings history. For Terrell County landlords seeking to build or optimize rental portfolios, our DSCR loans deliver the capital access needed for strategic property investments throughout the region.

DSCR Loan Terms for Terrell County

- Supported Assets: Single Family Dwellings, Condos & Apartment Buildings

- Lending Capacity - $75,000 to $2,500,000+ maximum per unit

- Interest Pricing - Beginning at 5.625%

- Amortization Types - Interest Only and Standard Amortization

- Contract Term - 30 Years (3, 5, 7, 10 Years Available)

- Loan Proceeds - Up to 80% of Purchase Price and 80% of As Is Value for Acquisitions, and up to 80% for Refinance

Across Terrell County's rental markets, Watermen Capital provides DSCR loans with regionally informed underwriting that reflects local property values, rental rates, and operating economics. Our DSCR financing features competitive terms structured for income property investors pursuing various strategies from buy and hold to value enhancement projects. As experienced DSCR lenders familiar with Terrell County's real estate landscape, we offer both purchase and refinance solutions for 1 to 4 unit residential properties and 5 to 10 unit multifamily investments. These property focused DSCR loans eliminate traditional income verification complexities, allowing investors to qualify based on rental performance metrics that truly matter for investment success.

Get a No-Obligation Dscr Loan Quote

Where We Lend

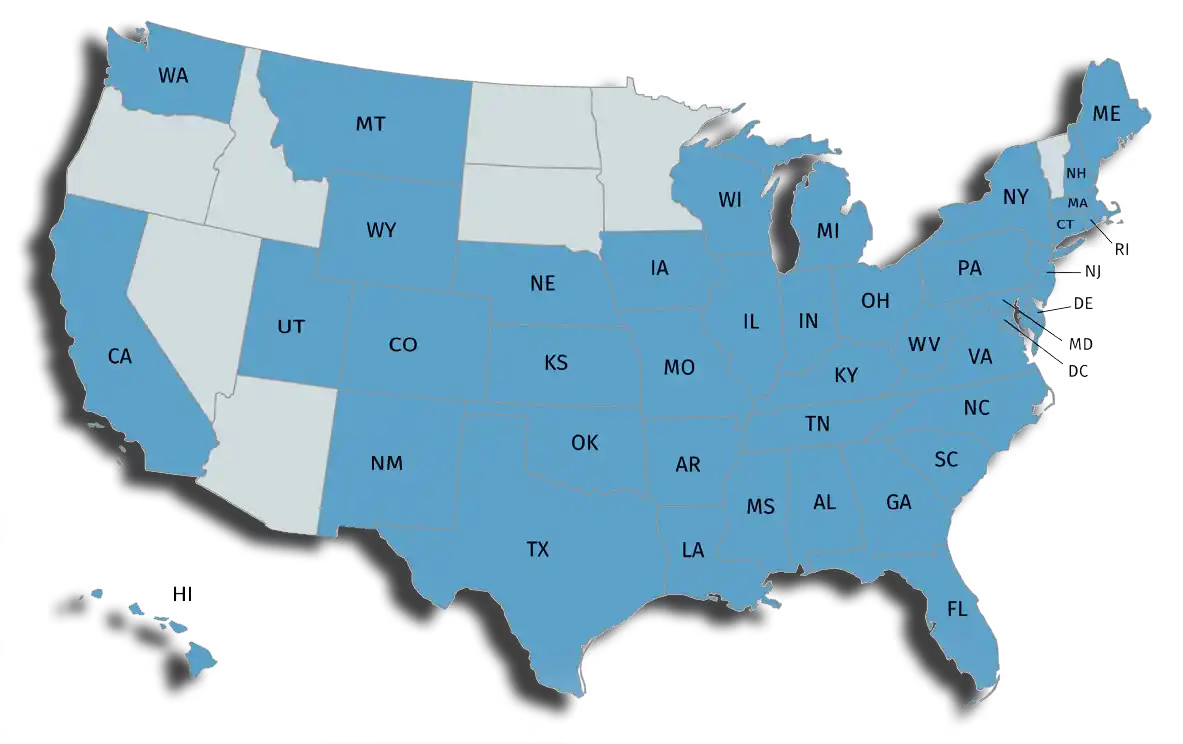

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.