Seminole, FL Hard Money Loans

Hard money loans have become essential tools for Seminole investors who need immediate capital without the restrictive approval process of traditional banks. By working with an experienced lender like Watermen Capital, borrowers can leverage real estate as collateral to quickly access funds for time-sensitive projects. This financing approach is particularly valuable in fast-moving markets where the ability to close quickly can make the difference between securing or losing exceptional investment opportunities.

When investing in Seminole's fast-moving real estate market, you need a lender who can close quickly and fund projects efficiently. Watermen Capital specializes in hard money loans for fix and flip projects, fix to rent conversions, ground up construction, and buy and hold rental properties, helping investors bypass the strict requirements of traditional banks. With our easy-to-use analytical tools and streamlined approval process, you can evaluate potential investments and secure funding faster than with conventional financing options, regardless of your investment strategy.

Home Value Trend for Seminole

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $481,729 | $588,602 | $606,853 | $621,450 | $595,891 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| -- | -- | $2,061 | $2,135 | $2,318 |

Get a No-Obligation Hard Money Loans Quote

Other Loan Services for Seminole

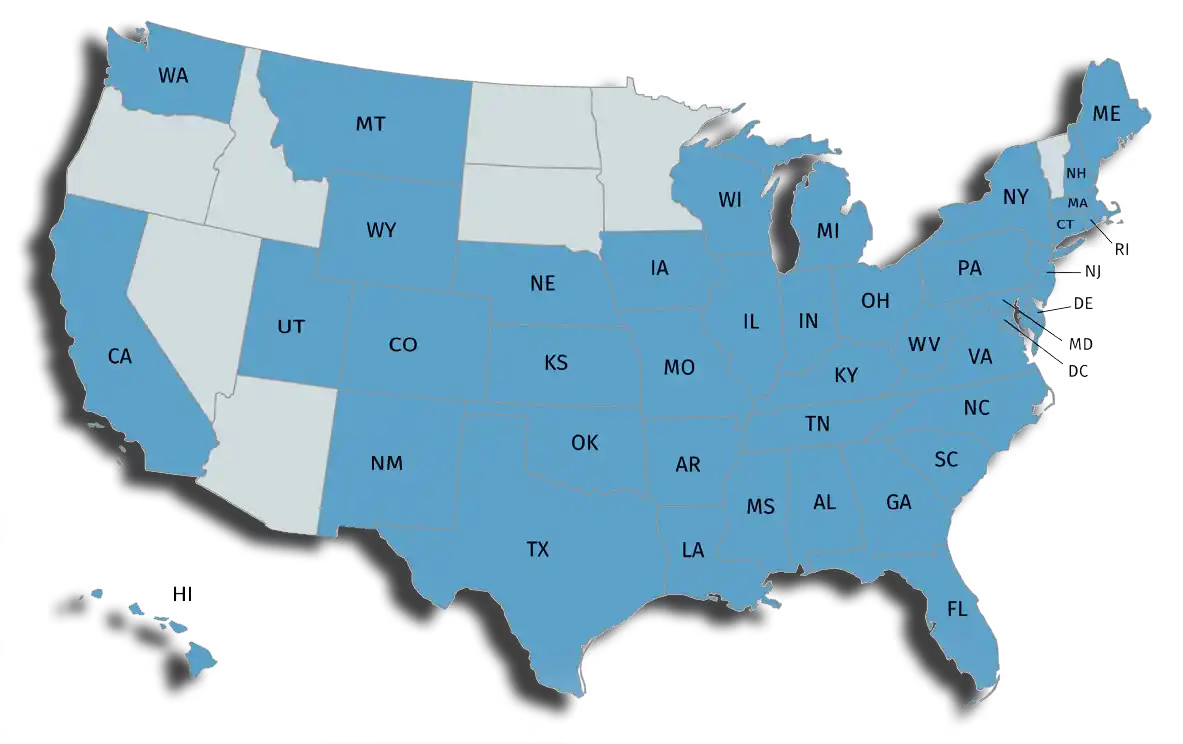

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.