San Bruno, CA Hard Money Loans

In the competitive San Bruno real estate market, hard money loans offer investors a significant advantage through rapid access to capital. Unlike conventional lenders who rely primarily on rigid credit evaluations, Watermen Capital takes a balanced approach - evaluating the property's potential while structuring solutions around credit considerations. This comprehensive assessment enables faster closings on valuable opportunities, giving experienced investors the speed and accessibility needed when securing potentially profitable deals that traditional financing might miss.

Watermen Capital offers both short-term real estate bridge loans and long-term DSCR rental loans to qualified San Bruno investors looking to expand their property portfolios. Our team of expert originators and underwriters brings deep experience in both real estate investing and lending, helping you find and fund your next deal with unprecedented speed. Whether your strategy involves fix and flip, fix to rent, ground up construction, or buy and hold rentals, our efficient documentation process and balanced approach to evaluating deals ensures our approval process serves investors who recognize that opportunity doesn't wait.

Home Value Trend for San Bruno

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $1,499,236 | $1,634,315 | $1,519,562 | $1,569,397 | $1,602,132 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $2,572 | $2,731 | $2,776 | $2,861 | $2,942 |

Get a No-Obligation Hard Money Loans Quote

Other Loan Services for San Bruno

Run a quick analysis for your next Hard Money Loan Deal

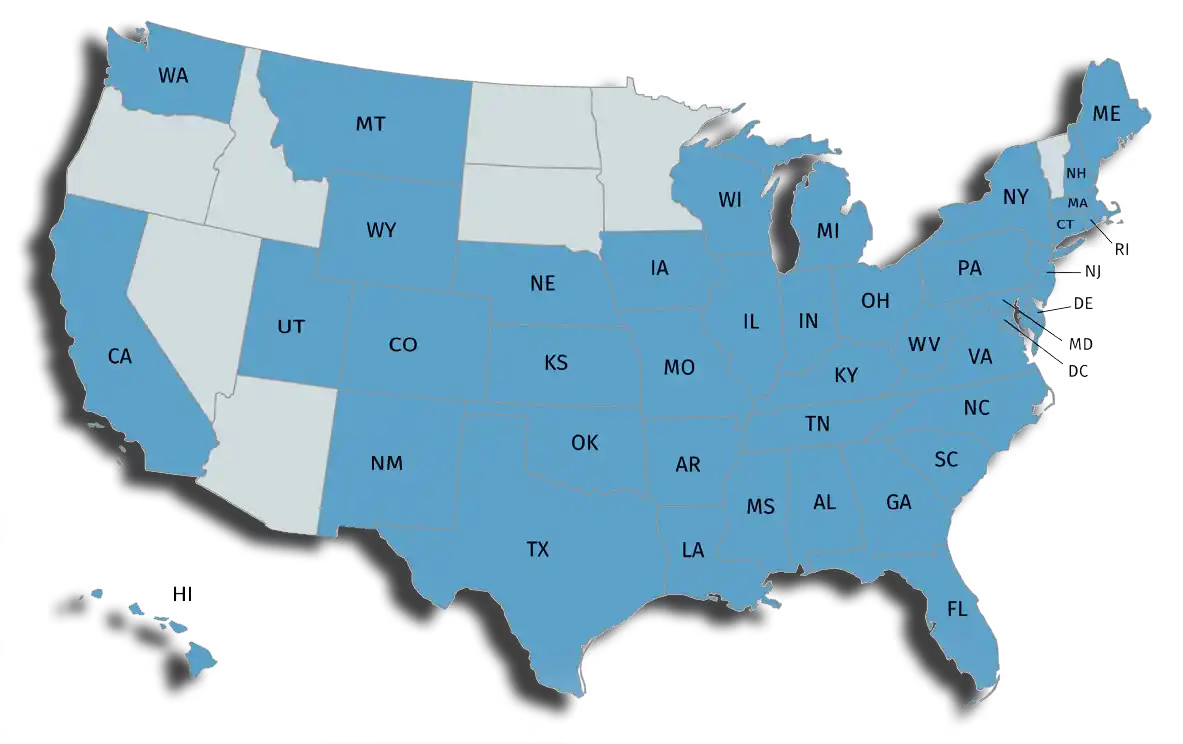

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.