Orangeburg, SC DSCR Loans

DSCR loans have revolutionized rental property investing in Orangeburg, offering savvy real estate entrepreneurs a powerful financing tool based on property performance rather than personal income constraints. Watermen Capital, as leading DSCR lenders serving Orangeburg investors, provides specialized DSCR financing for both residential rentals (1-4 units) and small multifamily properties (5-10 units) throughout Orangeburg's diverse neighborhoods. Our DSCR loans evaluate each property's debt service coverage ratio, measuring its ability to generate sufficient rental income to cover loan payments and operating expenses. This investment property focused approach allows Orangeburg landlords to scale their portfolios more effectively than possible with conventional financing options that emphasize borrower income over property performance.

Our DSCR loans offer Orangeburg investors simplified documentation requirements, focusing on property performance metrics rather than complex personal income verification. These specialized DSCR financing solutions support various investment strategies in Orangeburg's rental market, including long term buy and hold, value add improvements, and portfolio diversification across different neighborhoods. As established DSCR lenders serving Orangeburg's investment community, Watermen Capital delivers both purchase and refinance options for 1-4 unit residential properties and 5-10 unit multifamily buildings. Contact our experienced team today to discover how our tailored DSCR loans can help unlock your next Orangeburg rental property acquisition or optimize financing on your existing investment holdings.

Home Value Trend for Orangeburg

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $236,031 | $262,407 | $264,287 | $273,747 | $277,934 |

Get a No-Obligation Dscr Loans Quote

Other Loan Services for Orangeburg

Where We Lend

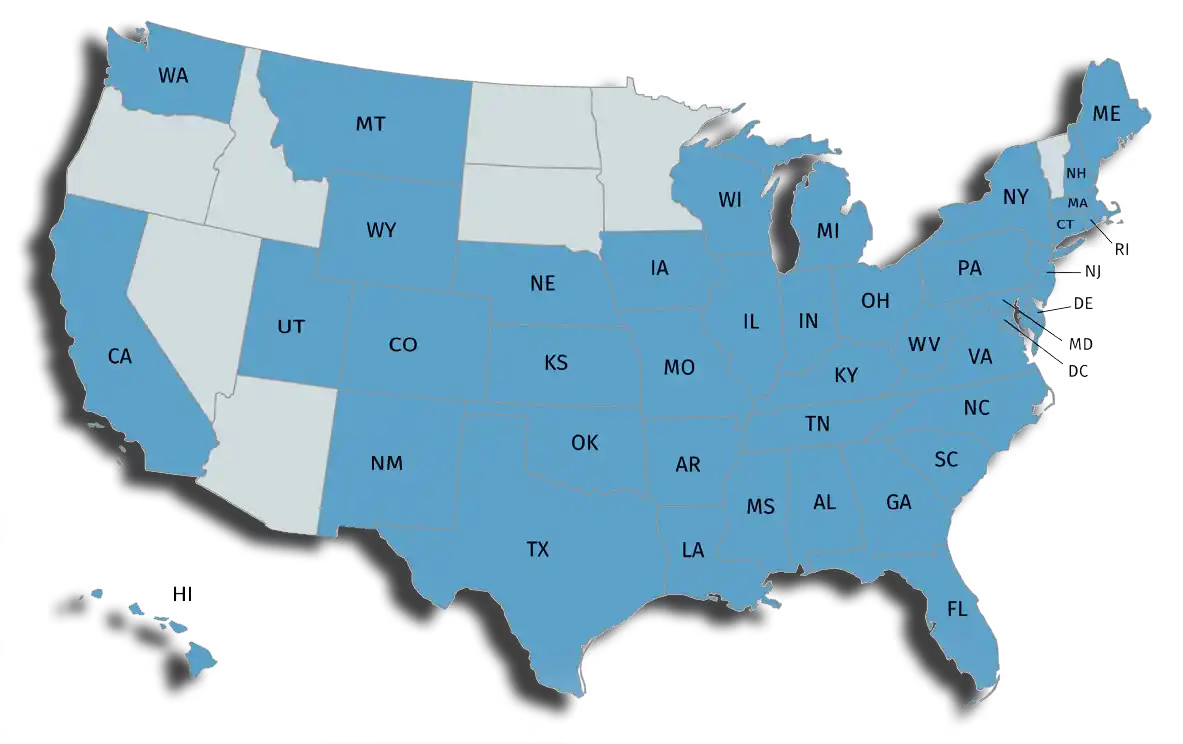

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.