Ohio County Fix And Flip Loans

Real estate investors throughout Ohio County partner with Watermen Capital for competitive fix and flip financing that addresses the complete investment cycle. Our fix and flip loan programs cover initial acquisitions of undervalued properties plus comprehensive renovation capital with distribution schedules synchronized to construction progress. Working with fix and flip investors across Ohio County—from urban core rehabilitation specialists to suburban transformation experts—our fix and flip financing provides both purchase funding and dedicated improvement capital aligned to project phases. With deep understanding of Ohio County property valuations, renovation costs, and local market dynamics, we structure fix and flip solutions for investors pursuing opportunities in metropolitan areas, developing communities, or transitional neighborhoods throughout the county.

Specialized fix and flip financing for Ohio County property markets starts with Watermen Capital's commitment to local expertise and investor-focused lending. We serve fix and flip rehabilitation projects throughout Ohio County with loan programs designed around regional property characteristics, construction timelines, and market absorption patterns. By combining competitive fix and flip loan terms with practical knowledge of Ohio County real estate trends, we help investors navigate acquisition opportunities and renovation projects with confidence, supported by fix and flip funding structured for regional market success.

Get a No-Obligation Fix And Flip Loans Quote

Where We Lend

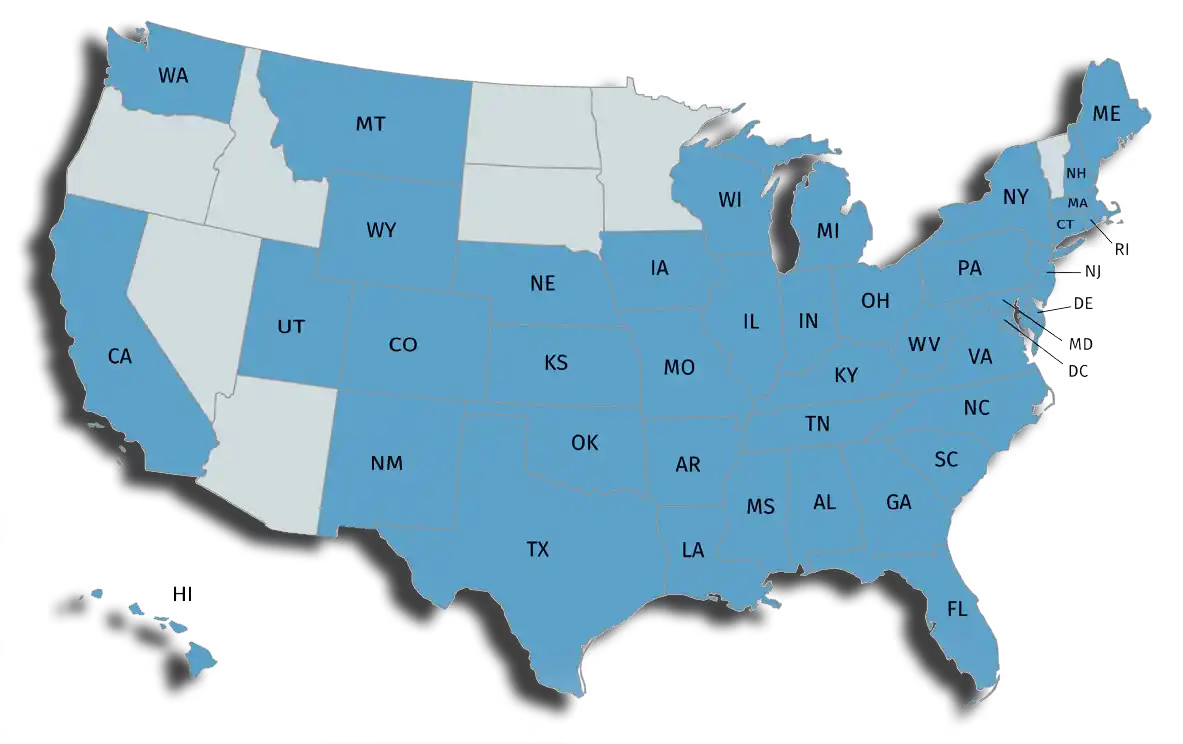

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.