Middle River, MD DSCR Loans

Looking for DSCR loans in Middle River for your next rental property acquisition? Watermen Capital delivers streamlined DSCR financing solutions designed specifically for income property investors building portfolios across Middle River neighborhoods. Our DSCR loans focus on what matters most: the property's capacity to generate positive cash flow. As specialized DSCR lenders understanding Middle River's rental market dynamics, we structure loans for 1-4 unit residential properties and 5-10 unit multifamily buildings that allow investors to qualify based on the property's rental income rather than personal earnings. This investor friendly approach to DSCR financing helps you expand your Middle River rental holdings without the limitations imposed by traditional income qualification methods.

Our DSCR loans offer Middle River investors simplified documentation requirements, focusing on property performance metrics rather than complex personal income verification. These specialized DSCR financing solutions support various investment strategies in Middle River's rental market, including long term buy and hold, value add improvements, and portfolio diversification across different neighborhoods. As established DSCR lenders serving Middle River's investment community, Watermen Capital delivers both purchase and refinance options for 1-4 unit residential properties and 5-10 unit multifamily buildings. Contact our experienced team today to discover how our tailored DSCR loans can help unlock your next Middle River rental property acquisition or optimize financing on your existing investment holdings.

Home Value Trend for Middle River

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $451,993 | $488,390 | $494,085 | $502,468 | $513,738 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $1,501 | $1,603 | $1,627 | $1,684 | $1,750 |

Get a No-Obligation Dscr Loans Quote

Other Loan Services for Middle River

Where We Lend

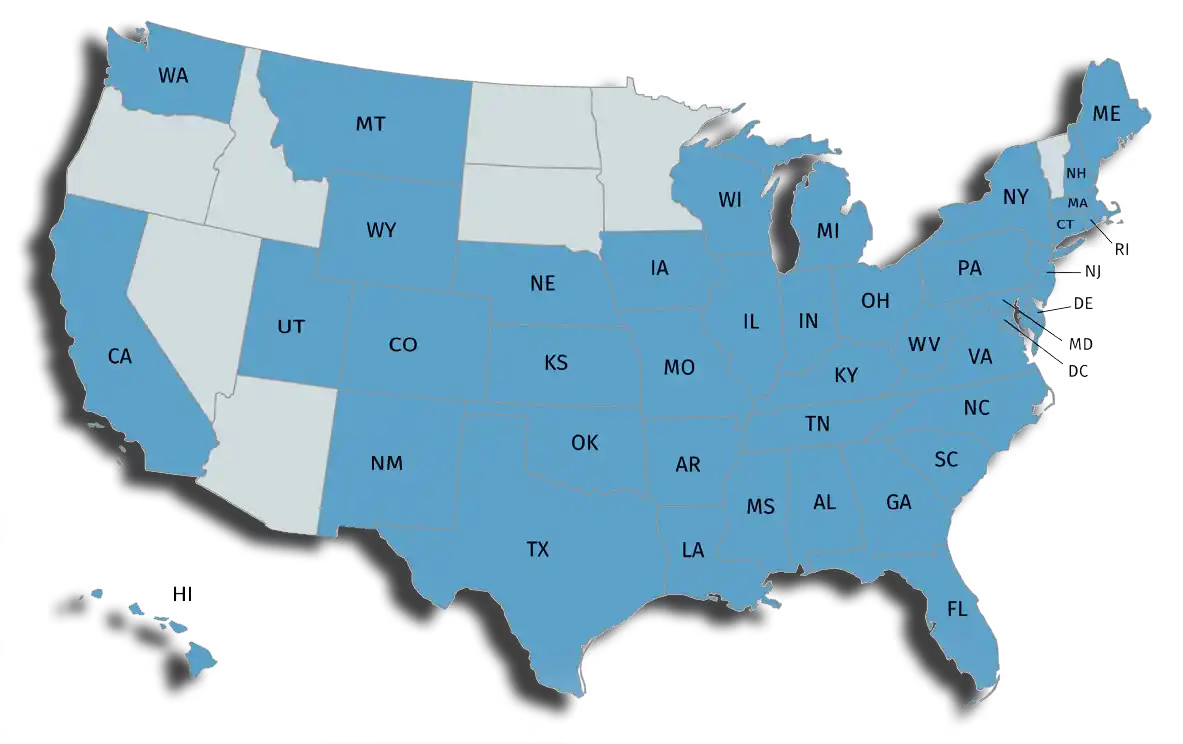

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.