Mercer Island, WA Hard Money

Hard money loans have become essential tools for Mercer Island investors who need immediate capital without the restrictive approval process of traditional banks. By working with an experienced lender like Watermen Capital, borrowers can leverage real estate as collateral to quickly access funds for time-sensitive projects. This financing approach is particularly valuable in fast-moving markets where the ability to close quickly can make the difference between securing or losing exceptional investment opportunities.

As a leading national hard money lender, Watermen Capital provides Mercer Island investors with flexible loan products and efficient closing processes that make real estate investing both straightforward and profitable. Whether you're planning a fix and flip, fix to rent, ground up construction, or buy and hold strategy, you need a lending partner that understands your business plan and can push your deal through with speed and flexibility. For real estate investing across multiple strategies in Mercer Island, Watermen Capital is that ideal hard money lending partner.

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $1,818,858 | $2,221,052 | $2,049,582 | $2,162,661 | $2,252,625 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $2,325 | $2,548 | $2,576 | $2,700 | $2,800 |

Get a No-Obligation Hard Money Quote

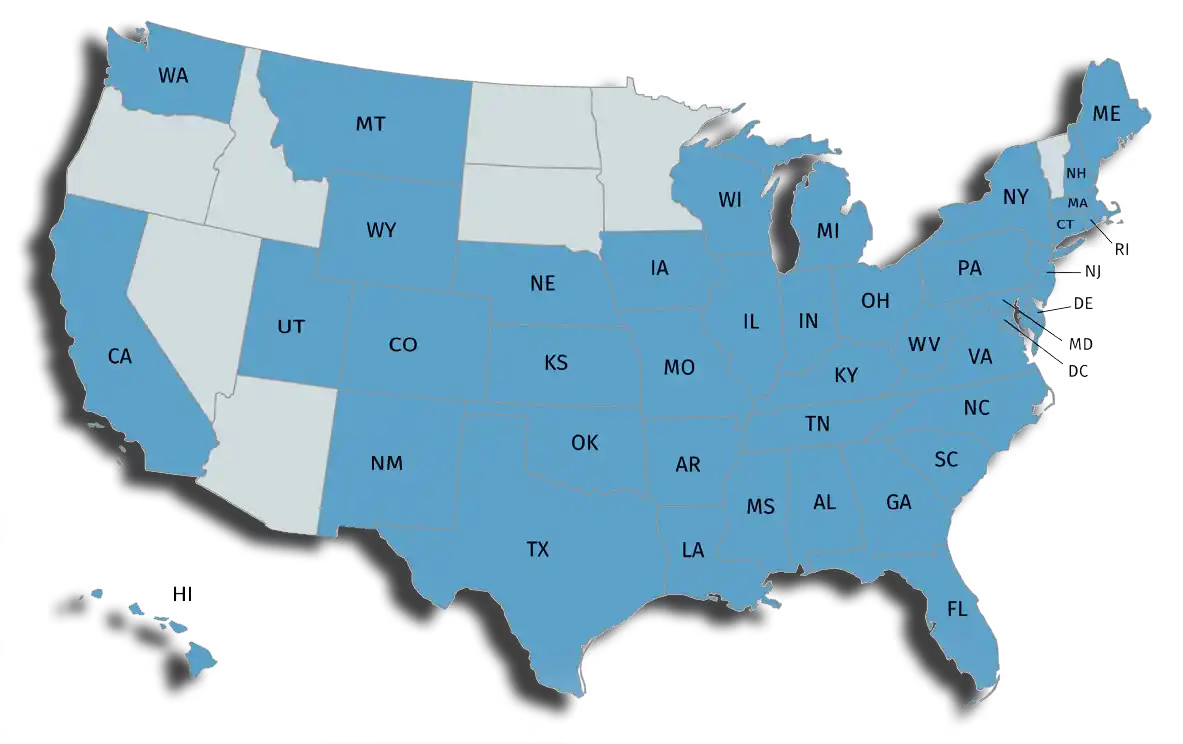

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.