Mendocino County DSCR Loan

Income property investors throughout Mendocino County benefit from DSCR loans that prioritize rental cash flow over traditional personal income requirements. Watermen Capital serves as your trusted DSCR lender, offering investment property financing for residential rentals (1 to 4 units) and small multifamily assets (5 to 10 units) across Mendocino County's varied communities. Our DSCR financing approach analyzes each property's debt service coverage capabilities, ensuring rental income can adequately support loan obligations while providing investors the flexibility to expand their portfolios. This property performance based lending strategy enables Mendocino County real estate entrepreneurs to overcome conventional financing barriers and accelerate their rental property acquisition goals.

Mendocino County DSCR Financing Terms

- Eligible Properties: Single Family Residences, Condos & Small Multifamily Buildings

- Property Loan Size - $75,000 to $2,500,000+ per asset

- Competitive Rates - From 5.625%

- Payment Structure - Interest Only & Full Amortization Available

- Term Length - 30 Years (3, 5, 7, 10 Years Available)

- Maximum Financing - Up to 80% of Purchase Price and 80% of As Is Value for Acquisitions, and up to 80% for Refinance

Across Mendocino County's rental markets, Watermen Capital provides DSCR loans with regionally informed underwriting that reflects local property values, rental rates, and operating economics. Our DSCR financing features competitive terms structured for income property investors pursuing various strategies from buy and hold to value enhancement projects. As experienced DSCR lenders familiar with Mendocino County's real estate landscape, we offer both purchase and refinance solutions for 1 to 4 unit residential properties and 5 to 10 unit multifamily investments. These property focused DSCR loans eliminate traditional income verification complexities, allowing investors to qualify based on rental performance metrics that truly matter for investment success.

Get a No-Obligation Dscr Loan Quote

Where We Lend

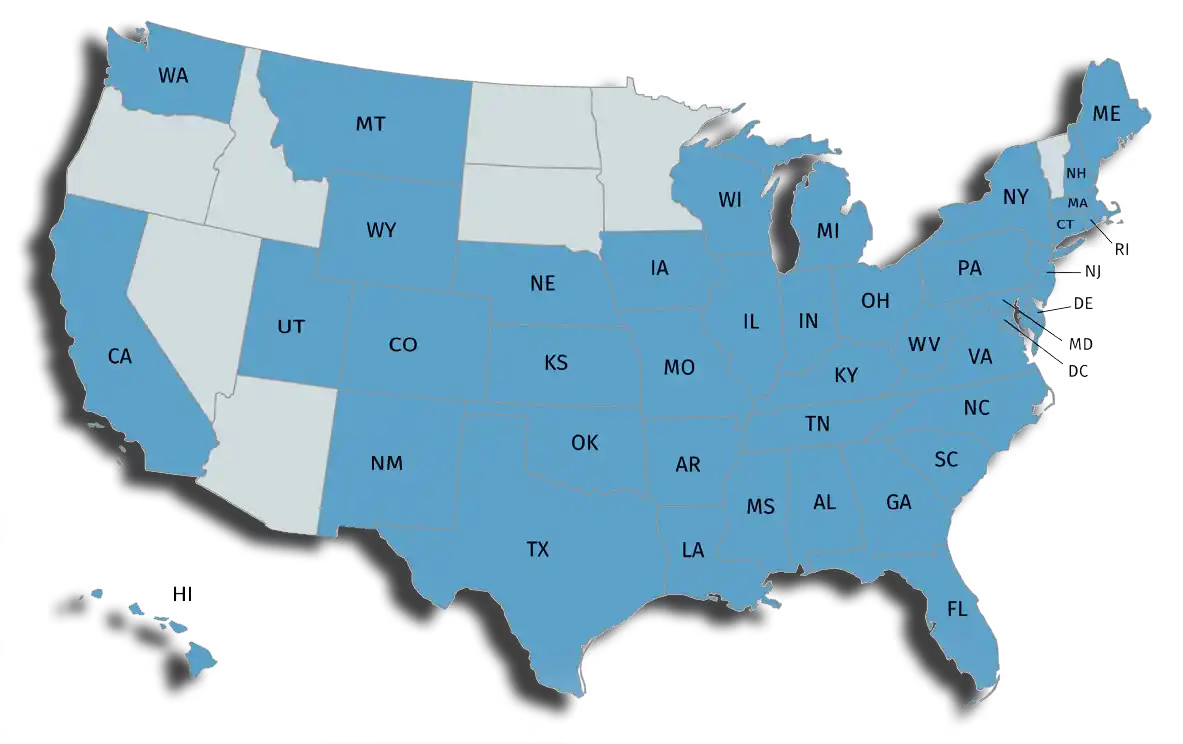

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.