Los Alamos, CA Fix And Flip Loans

Seeking rapid funding for your next Los Alamos, CA property flip? Watermen Capital's fix and flip loans provide the immediate cash flow needed to acquire distressed properties, complete transformative renovations, and sell for maximum profit. Our fix and flip loans are structured specifically for investors who identify undervalued properties and create equity through strategic improvements. With streamlined approvals for fix and flip loans, investor-friendly terms, and a team that understands renovation timelines, we empower you to act decisively when opportunity knocks in competitive real estate markets.

Watermen Capital's fix and flip loans feature accelerated funding timelines and rehabilitation-friendly terms built around typical renovation cycles. Our fix and flip loan structure accommodates both purchase and improvement costs with draw schedules aligned to construction milestones, ensuring capital is available precisely when needed during your property transformation. As specialists in fix and flip loans, we understand the critical timing between property acquisition, value-adding improvements, and strategic resale, providing the financial foundation necessary to maximize returns on each property flip in Los Alamos's dynamic real estate market.

Home Value Trend for Los Alamos

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $897,990 | $1,046,673 | $1,057,022 | $1,133,445 | $1,117,937 |

Get a No-Obligation Fix And Flip Loans Quote

Other Loan Services for Los Alamos

Where We Lend

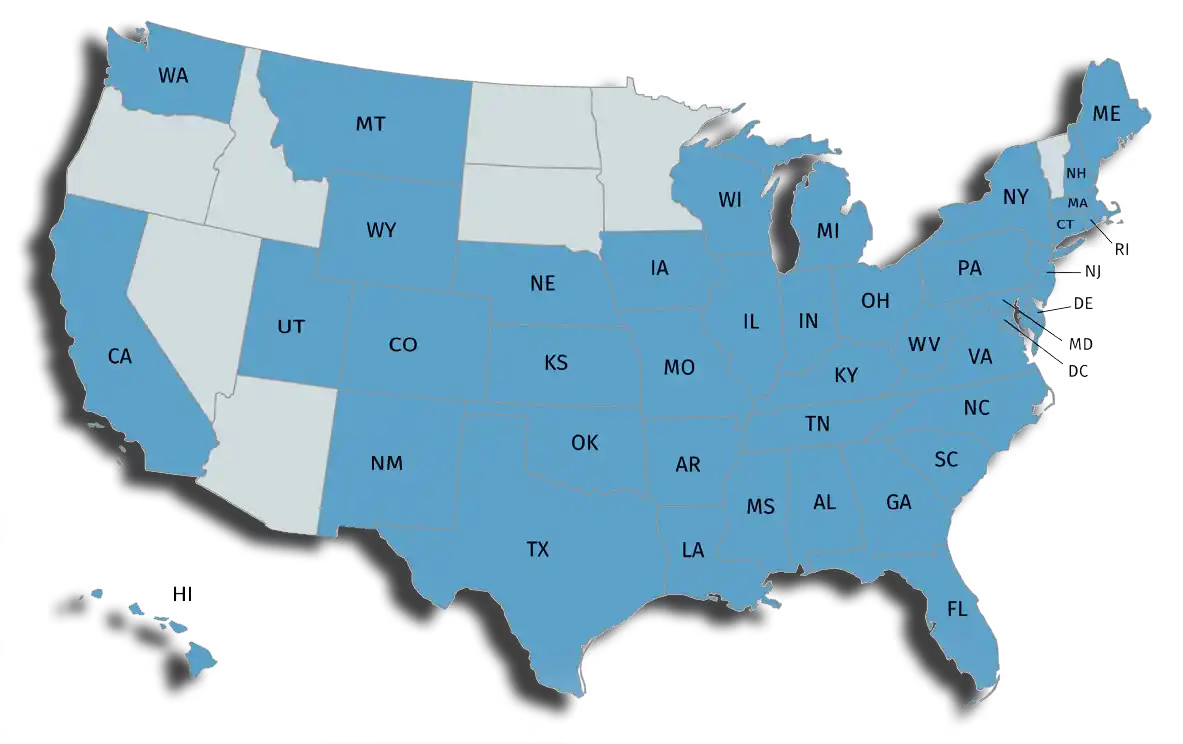

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.