Little Elm, TX Hard Money Loans

A hard money loan in Little Elm, TX, is a short-term, asset-based financing option provided by private lenders like Watermen Capital. These loans primarily consider property value while offering more flexible terms regarding credit history, making them ideal for real estate investors seeking efficient funding solutions. With faster approvals than traditional bank loans, hard money loans are perfect for fix-and-flip projects, commercial investments, or time-sensitive opportunities where speed and flexibility are crucial.

Watermen Capital offers both short-term real estate bridge loans and long-term DSCR rental loans to qualified Little Elm investors looking to expand their property portfolios. Our team of expert originators and underwriters brings deep experience in both real estate investing and lending, helping you find and fund your next deal with unprecedented speed. Whether your strategy involves fix and flip, fix to rent, ground up construction, or buy and hold rentals, our efficient documentation process and balanced approach to evaluating deals ensures our approval process serves investors who recognize that opportunity doesn't wait.

Home Value Trend for Little Elm

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $481,126 | $615,538 | $599,439 | $598,231 | $582,155 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $2,017 | $2,232 | $2,294 | $2,290 | $2,316 |

Get a No-Obligation Hard Money Loans Quote

Other Loan Services for Little Elm

Run a quick analysis for your next Hard Money Loan Deal

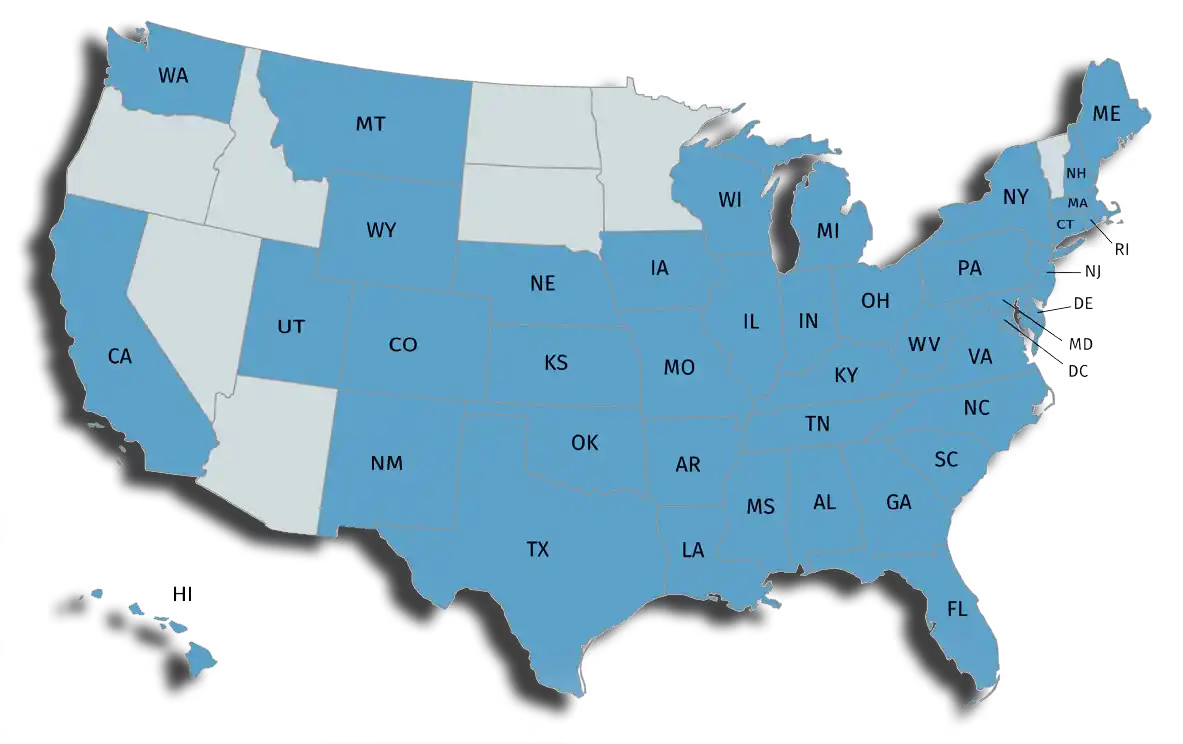

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.