La Junta, CO Fix And Flip Loans

Need specialized fix and flip loans for property rehabilitation projects in La Junta? Watermen Capital delivers fix and flip loans crafted exclusively for investors who transform distressed properties into market-ready homes. Our fix and flip financing solutions provide the upfront capital necessary for property acquisition plus dedicated renovation funds to cover construction costs, contractor payments, and carrying expenses. Drawing on extensive experience in property transformation projects, we understand renovation timelines, budget considerations, and the critical path to profitable exits that define successful fix and flip ventures.

Watermen Capital's fix and flip loans deliver strategically timed funding disbursements, with construction-friendly terms designed specifically for property transformation projects. Our fix and flip loan structure finances both distressed property acquisition and the critical improvements that create equity, helping you execute comprehensive rehabilitation plans without financial constraints. Whether you're undertaking light cosmetic enhancements or gut renovations requiring substantial structural improvements, we provide reliable fix and flip financing for every stage of the property transformation cycle. Partner with Watermen Capital for fix and flip loans that support successful property flips in La Junta and throughout your target markets.

Home Value Trend for La Junta

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $237,448 | $274,598 | $269,812 | $266,550 | $279,956 |

Get a No-Obligation Fix And Flip Loans Quote

Other Loan Services for La Junta

Where We Lend

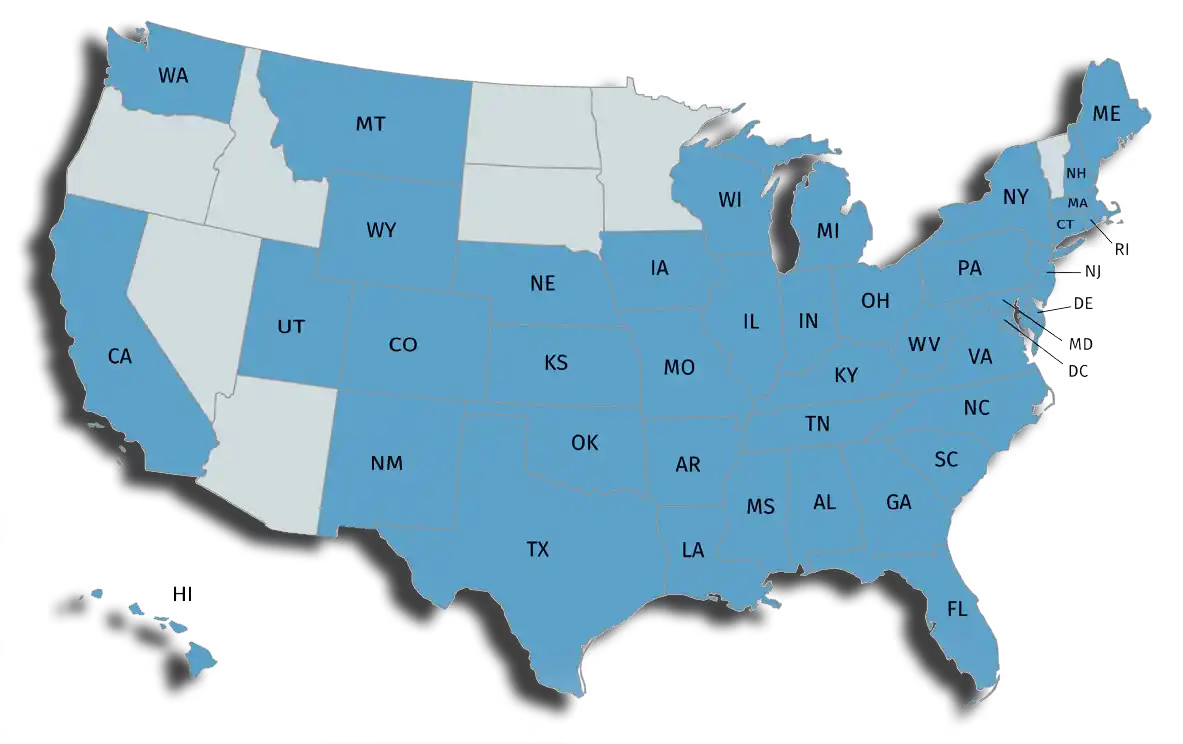

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.