Hampton Bays, NY Private Money Loans

Private money loans have become essential for Hampton Bays investors who need quick cash without dealing with all the paperwork and delays of traditional banks. By working with an experienced private money lender like Watermen Capital, you can use your property as collateral to quickly get funds for time-sensitive projects. This private money financing approach is especially valuable in fast-moving markets where being able to close quickly can mean the difference between getting or losing a great investment opportunity.

Watermen Capital, a trusted private money lender, offers both short-term bridge loans and long-term rental loans to Hampton Bays investors looking to grow their property portfolios. Our team brings real-world experience in both real estate investing and private money loans, helping you find and fund your next deal quickly. Whether you're flipping houses, converting properties to rentals, building from scratch, or buying rental properties, our simple private money financing process and practical approach ensures we can help investors who know that good opportunities don't stick around for long.

Home Value Trend for Hampton Bays

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $1,011,877 | $1,161,558 | $1,210,702 | $1,289,555 | $1,322,413 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| -- | -- | -- | -- | $9,155 |

Get a No-Obligation Private Money Loans Quote

Other Loan Services for Hampton Bays

Run a quick analysis for your next Private Money Loan Deal

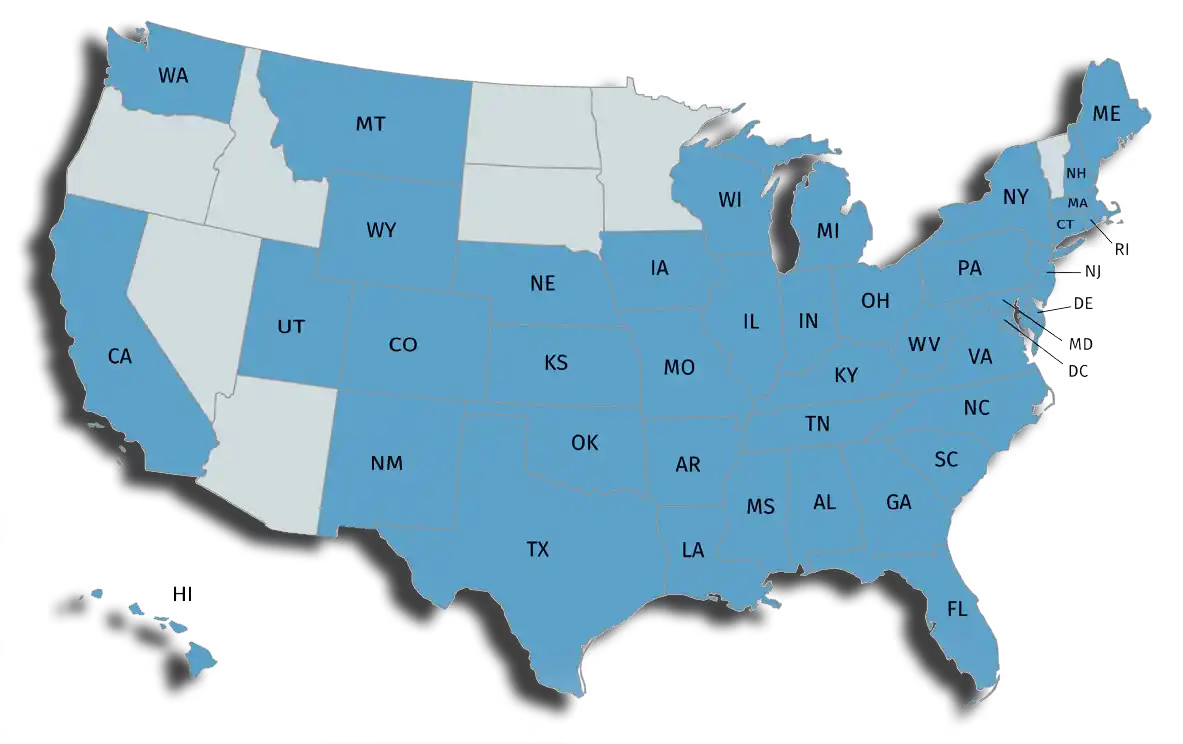

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.