Fennville, MI Bridge Loan

Find Your Bridge Loan in Fennville, MI with Watermen Capital. Need short-term financing for your real estate investment? Our bridge loans provide immediate liquidity and cash flow while you execute your business plan or secure long-term funding. Whether you're navigating a property flip, rehab project, or rental acquisition, our expert team helps "bridge" the gap between purchase and sale or permanent financing, giving investors the flexibility they need to seize opportunities.

Watermen Capital's bridge loans deliver the quick capital deployment investors need with flexible terms and prepayment options that adapt to your project timeline. Our investor-focused loan structure provides the immediate funding you need to seize property opportunities without unnecessary delays or constraints. Whether it's a quick cosmetic flip or a full rehab project, don't let funding gaps slow down your real estate investing strategy-partner with Watermen Capital, your ideal bridge lending partner in Fennville and throughout the country.

Home Value Trend for Fennville

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $566,387 | $639,118 | $647,142 | $675,290 | $708,931 |

Get a No-Obligation Bridge Loan Quote

Other Loan Services for Fennville

Where We Lend

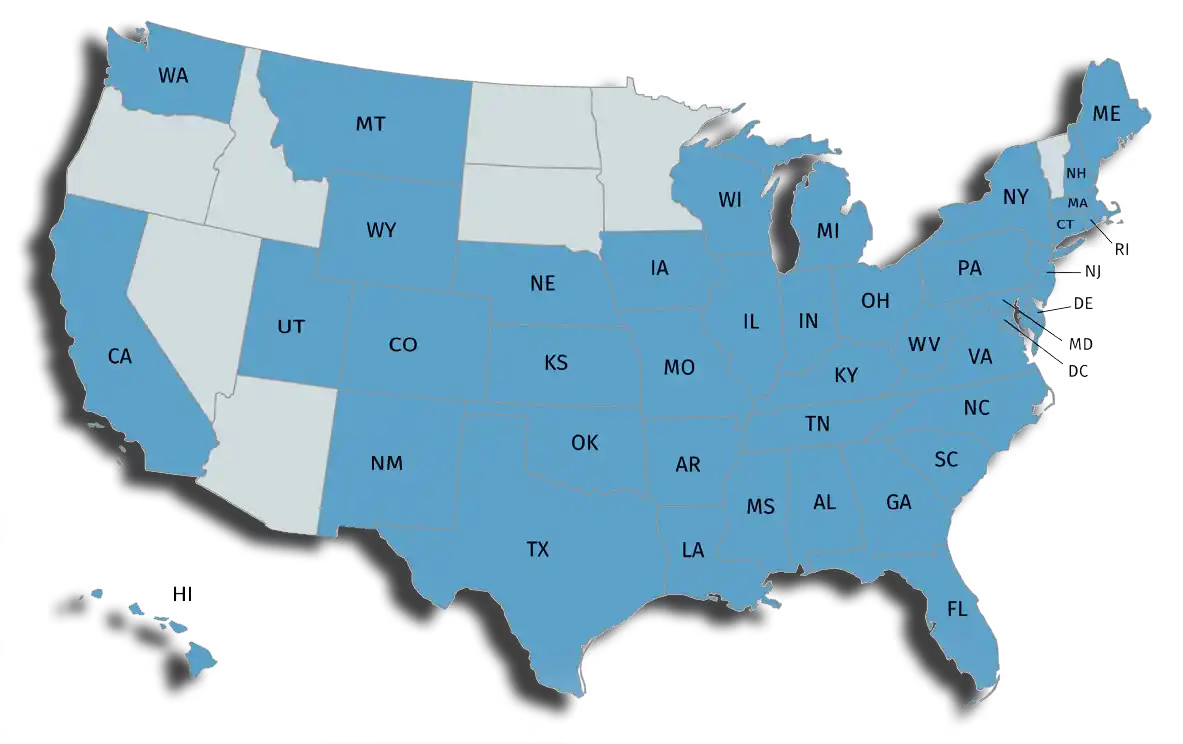

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.