El Cajon, CA DSCR Loans

DSCR loans in El Cajon, CA, provide real estate investors with income property financing based on rental cash flow rather than personal income. As experienced DSCR lenders, Watermen Capital offers these specialized investment property loans for both residential units (1-4 properties) and small multifamily buildings (5-10 units) throughout El Cajon. Our DSCR financing evaluates the property's ability to generate sufficient rental income to cover loan payments, creating opportunities for portfolio expansion without the traditional income verification requirements that can limit conventional borrowing capacity. For El Cajon investors focused on building rental portfolios, these DSCR loans deliver the financial leverage needed to scale your real estate business efficiently.

Watermen Capital's DSCR loans feature investor friendly qualification processes tailored specifically for El Cajon rental property owners acquiring single family homes, duplexes, triplexes, fourplexes, and small multifamily buildings up to eight units. Our DSCR financing programs include competitive rates, flexible terms, and loan structures designed around the unique needs of income property investors. As dedicated DSCR lenders with deep experience in El Cajon's rental markets, we understand local property values, rental income potentials, and the operating costs that impact investment performance. Whether purchasing your first rental or expanding an established portfolio, our DSCR loans provide the reliable financing foundation necessary for building long term wealth through El Cajon real estate.

Home Value Trend for El Cajon

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $865,206 | $998,328 | $1,001,386 | $1,094,257 | $1,104,047 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $1,776 | $2,210 | $2,366 | $2,443 | $2,480 |

Get a No-Obligation Dscr Loans Quote

Other Loan Services for El Cajon

Where We Lend

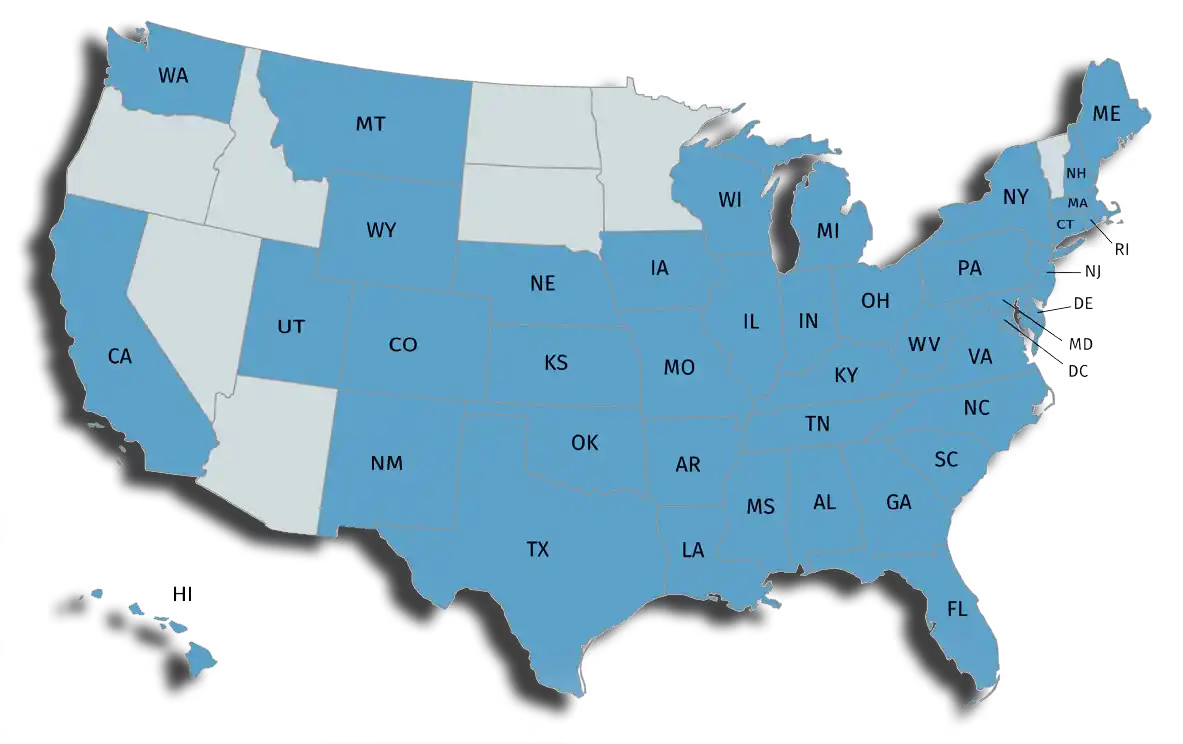

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.