East Chicago, IN Hard Money Loans

A hard money loan in East Chicago, IN, is a short-term, asset-based financing option provided by private lenders like Watermen Capital. These loans primarily consider property value while offering more flexible terms regarding credit history, making them ideal for real estate investors seeking efficient funding solutions. With faster approvals than traditional bank loans, hard money loans are perfect for fix-and-flip projects, commercial investments, or time-sensitive opportunities where speed and flexibility are crucial.

As a leading national hard money lender, Watermen Capital provides East Chicago investors with flexible loan products and efficient closing processes that make real estate investing both straightforward and profitable. Whether you're planning a fix and flip, fix to rent, ground up construction, or buy and hold strategy, you need a lending partner that understands your business plan and can push your deal through with speed and flexibility. For real estate investing across multiple strategies in East Chicago, Watermen Capital is that ideal hard money lending partner.

Home Value Trend for East Chicago

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $145,685 | $167,651 | $177,323 | $185,838 | $186,455 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| -- | -- | -- | $896 | $928 |

Get a No-Obligation Hard Money Loans Quote

Other Loan Services for East Chicago

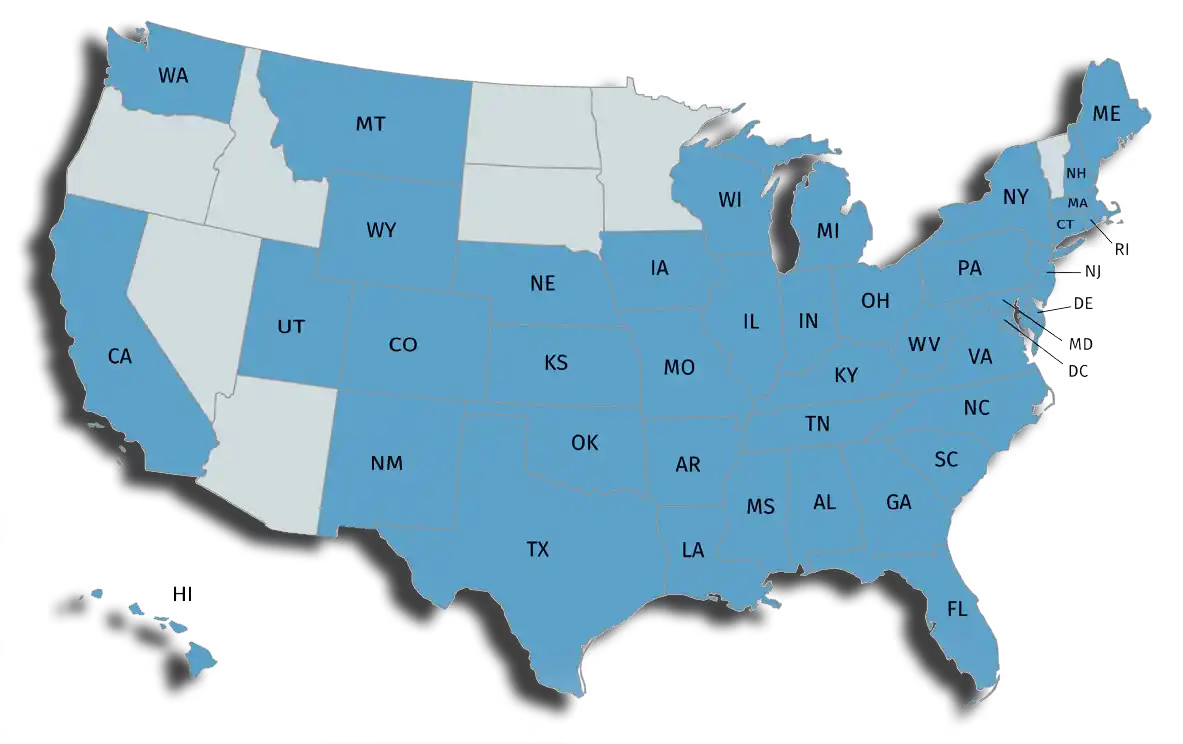

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.