Dodge City, KS DSCR Loans

Looking for DSCR loans in Dodge City for your next rental property acquisition? Watermen Capital delivers streamlined DSCR financing solutions designed specifically for income property investors building portfolios across Dodge City neighborhoods. Our DSCR loans focus on what matters most: the property's capacity to generate positive cash flow. As specialized DSCR lenders understanding Dodge City's rental market dynamics, we structure loans for 1-4 unit residential properties and 5-10 unit multifamily buildings that allow investors to qualify based on the property's rental income rather than personal earnings. This investor friendly approach to DSCR financing helps you expand your Dodge City rental holdings without the limitations imposed by traditional income qualification methods.

Watermen Capital's DSCR loans empower Dodge City investors to build substantial rental portfolios by qualifying based on property performance rather than personal income limitations. Our innovative DSCR financing programs cover residential investment properties from single family homes to eightplexes, with loan structures specifically designed for the unique cash flow characteristics of income producing real estate. As knowledgeable DSCR lenders focused on Dodge City's diverse rental markets, we understand the metrics that matter most for successful property investing. Whether acquiring established rentals or properties requiring strategic improvements to increase income potential, our DSCR loans provide the financial foundation necessary for sustainable portfolio growth in Dodge City's competitive real estate environment.

Home Value Trend for Dodge City

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $234,002 | $262,253 | $281,865 | $300,239 | $311,150 |

Get a No-Obligation Dscr Loans Quote

Other Loan Services for Dodge City

Where We Lend

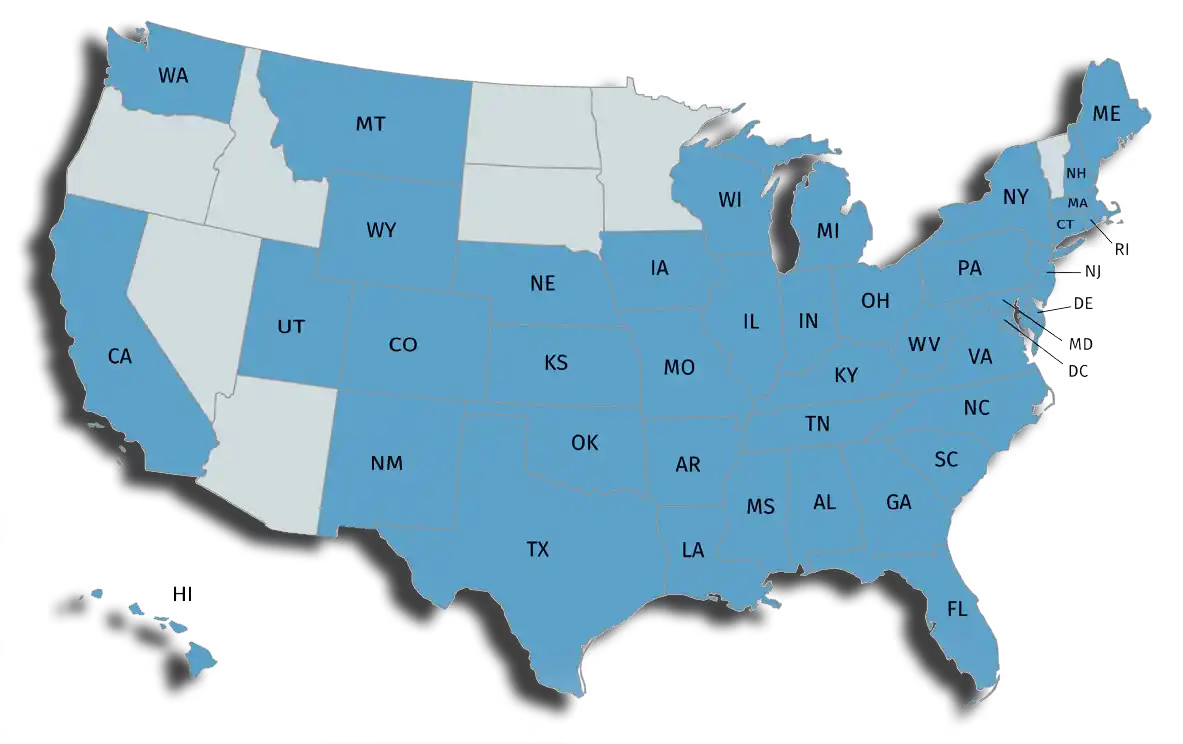

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.