Diamond Bar, CA Hard Money Loans

In the competitive Diamond Bar real estate market, hard money loans offer investors a significant advantage through rapid access to capital. Unlike conventional lenders who rely primarily on rigid credit evaluations, Watermen Capital takes a balanced approach - evaluating the property's potential while structuring solutions around credit considerations. This comprehensive assessment enables faster closings on valuable opportunities, giving experienced investors the speed and accessibility needed when securing potentially profitable deals that traditional financing might miss.

As a leading national hard money lender, Watermen Capital provides Diamond Bar investors with flexible loan products and efficient closing processes that make real estate investing both straightforward and profitable. Whether you're planning a fix and flip, fix to rent, ground up construction, or buy and hold strategy, you need a lending partner that understands your business plan and can push your deal through with speed and flexibility. For real estate investing across multiple strategies in Diamond Bar, Watermen Capital is that ideal hard money lending partner.

Home Value Trend for Diamond Bar

Year over Year| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $1,055,670 | $1,228,250 | $1,218,886 | $1,304,212 | $1,341,513 |

| 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| $2,410 | $2,641 | $2,847 | $2,935 | $3,006 |

Get a No-Obligation Hard Money Loans Quote

Other Loan Services for Diamond Bar

Run a quick analysis for your next Hard Money Loan Deal

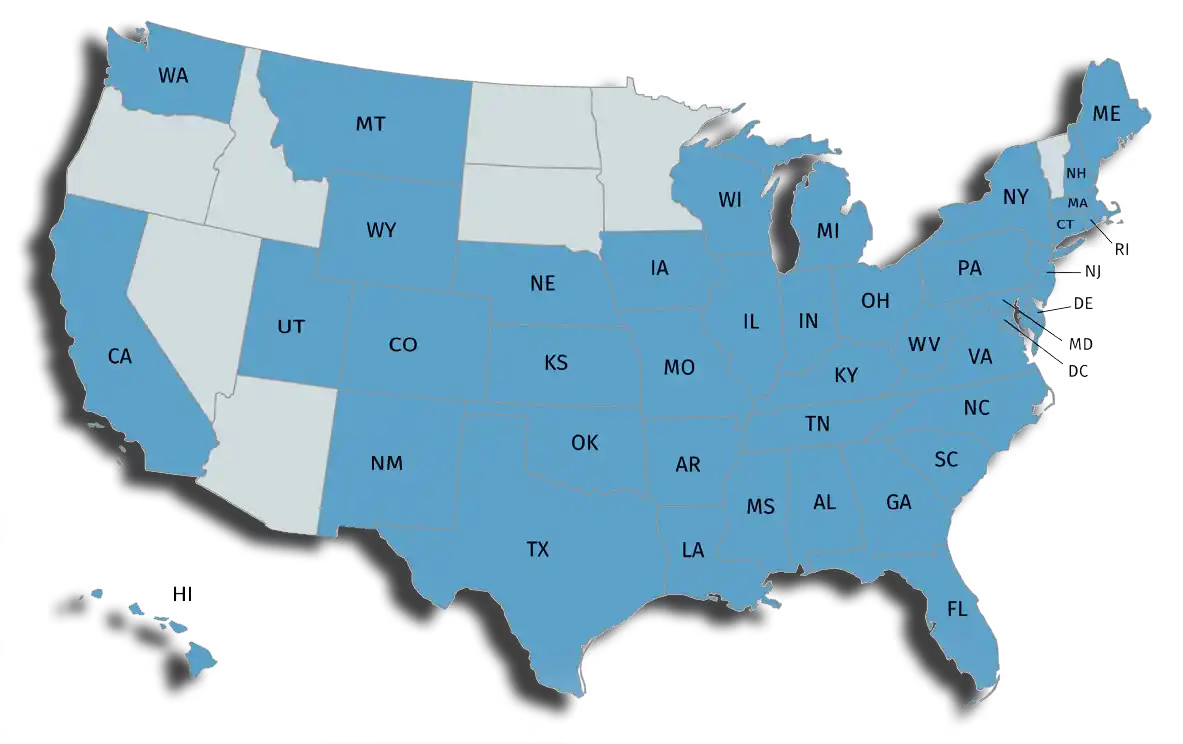

Where We Lend

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.