Collier County DSCR Loan

Real estate investors across Collier County discover enhanced financing opportunities through Watermen Capital's DSCR loans, designed specifically for income property acquisition and portfolio growth strategies. Our DSCR lending expertise covers residential investment properties (1 to 4 units) and small multifamily buildings (5 to 10 units) throughout Collier County, with underwriting focused on rental income capacity rather than traditional borrower qualification metrics. These specialized DSCR financing programs measure each property's ability to generate sufficient cash flow for debt service coverage, enabling investors to scale their holdings based on asset fundamentals. Whether targeting established rental properties or value add opportunities, our DSCR loans provide the financial structure necessary for successful real estate investing throughout Collier County.

Collier County DSCR Financing Terms

- Eligible Properties: Single Family Residences, Condos & Small Multifamily Buildings

- Property Loan Size - $75,000 to $2,500,000+ per asset

- Competitive Rates - From 5.625%

- Payment Structure - Interest Only & Full Amortization Available

- Term Length - 30 Years (3, 5, 7, 10 Years Available)

- Maximum Financing - Up to 80% of Purchase Price and 80% of As Is Value for Acquisitions, and up to 80% for Refinance

Watermen Capital's DSCR loans throughout Collier County feature streamlined processes emphasizing property cash flow analysis over complex personal financial documentation. Our DSCR lending programs accommodate diverse investment approaches across Collier County communities, supporting everything from starter rental acquisitions to sophisticated portfolio expansion strategies. With deep understanding of regional market dynamics, we structure DSCR financing that responds to local rental demand patterns, property appreciation trends, and operational cost factors unique to Collier County. Connect with our team to explore how tailored DSCR loans can accelerate your Collier County rental property objectives through financing solutions designed around investment property fundamentals.

Get a No-Obligation Dscr Loan Quote

Where We Lend

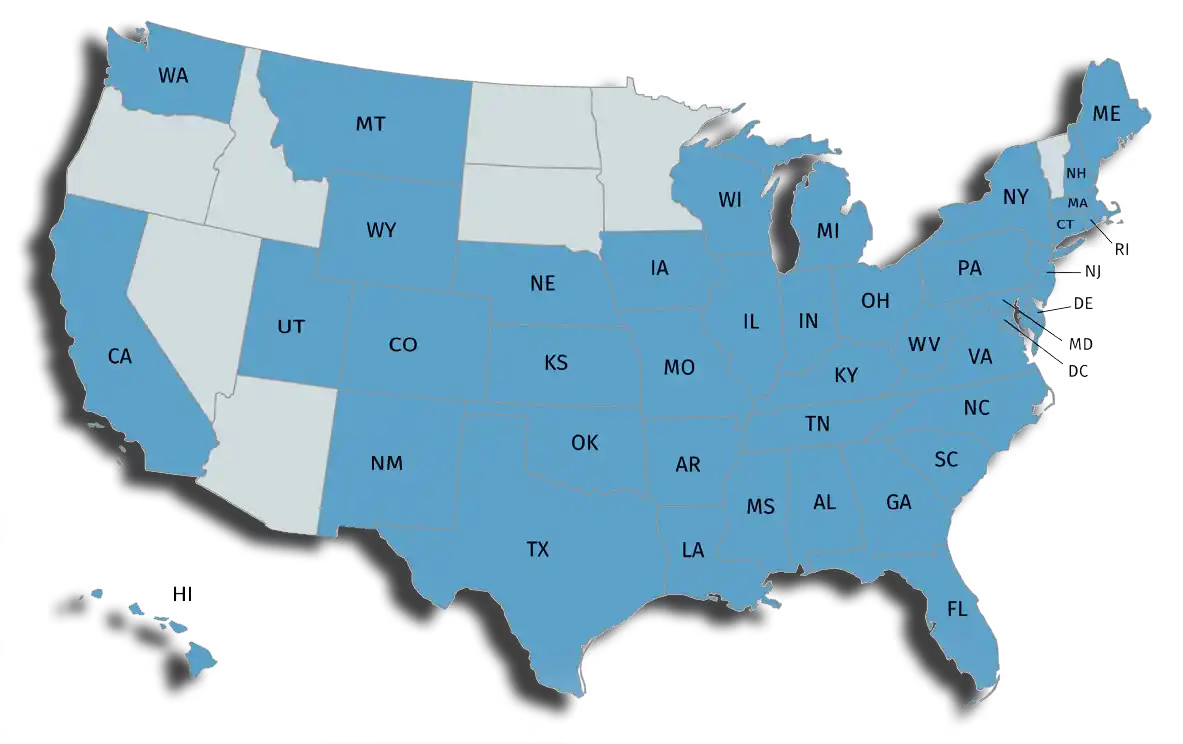

Watermen currently lends on residential properties in Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

Watermen is not currently licensed in AZ, ID, MN, ND, NV, OR, SD, UT or VT. Watermen Capital LLC is licensed or exempt from licensing in all other states. Your annual percentage rate may be increased after the fixed-rate period expires. Loans are subject to additional underwriting criteria.